Checklist to Unlock ALE Coverage

1. Contact Your Insurance Company

Contact your insurance company to file a claim and clearly state that your home is not livable. Specifically request that ALE coverage be opened or activated as part of your claim.

2. Request ALE HOUSING

Direct your insurance company to use ALE Housing as your preferred vendor to arrange your temporary accommodations.

3. Document Your Concerns

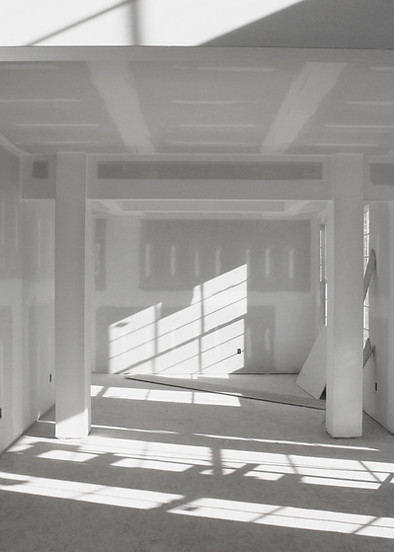

Take photos and videos of unsafe or unlivable conditions.

Make a list of issues affecting your safety or ability to stay at home.

Keep all receipts for lodging, food, or other expenses related to the situation.

4. Get Medical Documentation (if applicable)

Contact your primary care physician or use telehealth services.

Request a written statement about any health or safety risks due to your home’s condition.

5. Follow Up if Needed

If you’re not getting a response, escalate to a claims manager or supervisor. File a formal complaint if progress is stalled.

6. Request Written Confirmation

Ask your insurer for written confirmation that ALE coverage is being reviewed or has been approved, and that ALE Housing is your chosen vendor.

What To Do Next

Avoid the Hotel Hassle

The purpose of ALE coverage is to help policyholders maintain a similar standard of living while their home is uninhabitable or undergoing repairs. It typically covers expenses such as temporary housing, food, transportation, storage of belongings, and other necessary additional living expenses.